Temporary Climate Control and Dehumidification Businesses Insurance

or call us: 888-862-1202

When extreme weather strikes, temporary climate control and dehumidification services become critical for homes and businesses alike. From battling the aftermath of floods to managing indoor air quality during heat waves, these businesses face unique risks that demand tailored insurance coverage. The rising frequency of billion-dollar weather events in the U.S., which jumped from 24 in 2023 to 27 in 2024 causing $64.8 billion in damages, highlights the growing need for specialized protection in this sector The Zebra. Understanding the nuances of insurance for temporary climate control and dehumidification businesses is essential to safeguard operations, equipment, and client properties.

Unique Risks in Temporary Climate Control and Dehumidification

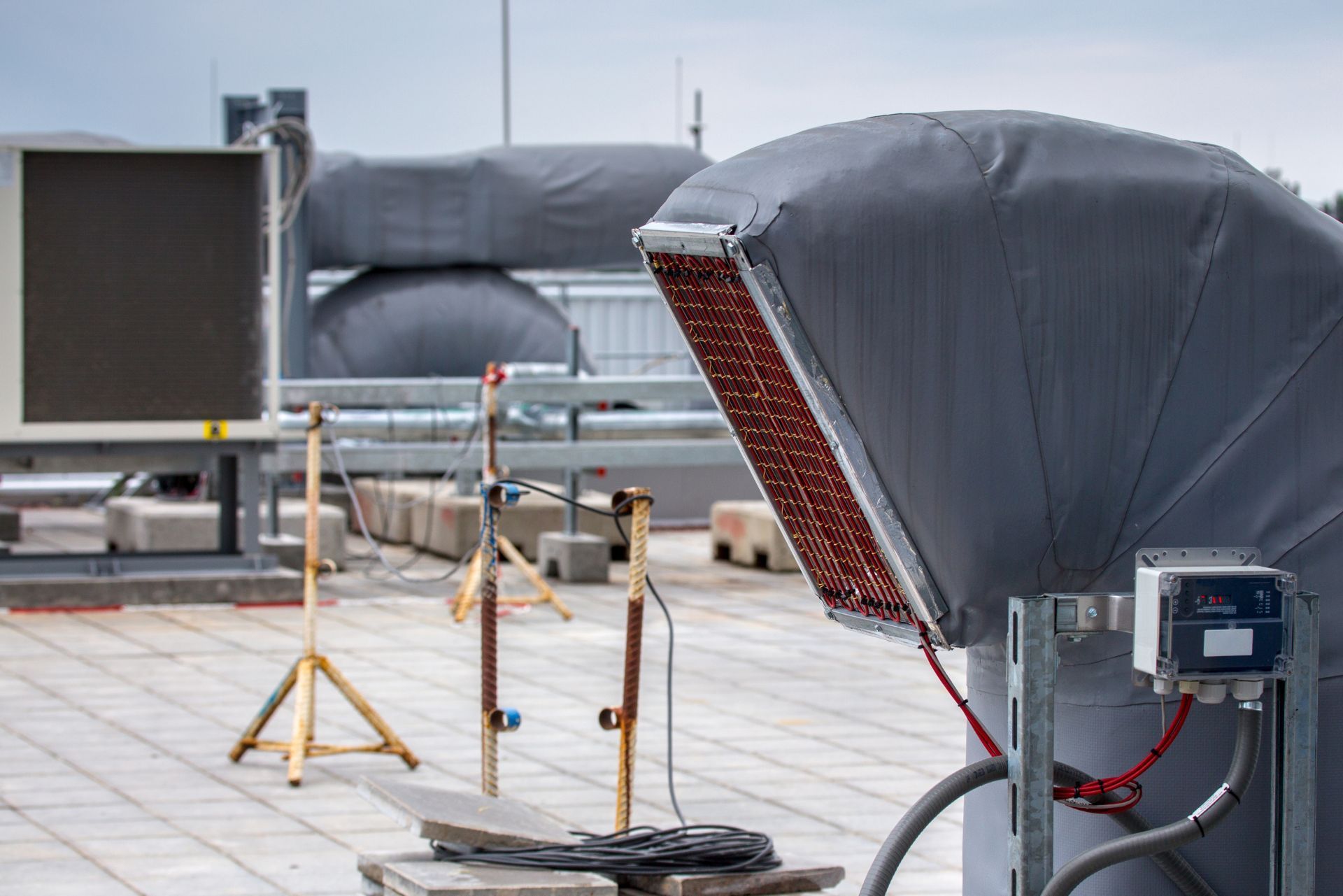

Temporary climate control and dehumidification companies operate in volatile environments. Their work often involves emergency response to weather-related disasters, such as floods or heat waves, where conditions can change rapidly. Equipment damage, property damage claims, and liability exposures are common challenges.

One notable risk is the impact of inflation on repair and replacement costs. Inflation can push expenses beyond what was initially anticipated in insurance policies, creating hidden financial risks HVACInsure. This means businesses need coverage that anticipates fluctuating costs, especially as inflation continues to affect the broader economy. Furthermore, the rising costs of raw materials and labor can also strain budgets, forcing companies to make difficult decisions regarding project timelines and resource allocation. These financial pressures can lead to a cascading effect, impacting everything from staffing levels to the quality of service provided.

Additionally, the U.S. Department of Energy’s recent proposal to rescind amended energy conservation standards for non-whole-home dehumidifiers could influence equipment efficiency and operational costs Mordor Intelligence. This regulatory uncertainty adds another layer of complexity for businesses relying on such equipment. As companies navigate these changes, they may find themselves needing to invest in newer technologies that comply with evolving standards, further complicating their financial outlook and operational strategies.

Weather-Driven Claims and Operational Challenges

With the increasing frequency of extreme weather events, insurers are seeing more claims related to property damage and business interruptions. In 2022, 75% of the property and casualty sector’s insured losses, totaling $74 billion, were tied to the U.S. homeowner segment Deloitte Insights. Temporary climate control businesses often work directly with homeowners and commercial clients affected by these disasters, making their exposure to claims significant. This growing trend necessitates that companies not only enhance their response capabilities but also invest in robust risk management strategies to mitigate potential losses.

Moreover, sustained higher atmospheric temperatures have been shown to reduce milk yields in dairy cattle, illustrating how climate extremes impact industries reliant on controlled environments

Descartes Underwriting. While this example is agricultural, it underscores the broader challenge of maintaining optimal conditions amid rising temperatures—a core service for climate control businesses. Additionally, industries such as pharmaceuticals and food processing are equally vulnerable, as they require precise temperature and humidity levels to ensure product integrity. As climate variability continues to escalate, the demand for reliable climate control solutions will only grow, placing further pressure on companies to innovate and adapt to these challenges effectively.

HVACInsure is fully licensed and permitted to sell contractor and commercial insurance in USA.

We proudly serve clients throughout the United States and maintain partnerships with local Texas insurance carriers to ensure HVAC professionals receive compliant, affordable, and comprehensive coverage that meets project and regulatory requirements.

Insurance Solutions Tailored for Temporary Climate Control and Dehumidification

Insurance coverage for these businesses must address equipment protection, liability, business interruption, and the evolving risks posed by climate change. Standard commercial policies often fall short in covering the specialized exposures faced by temporary climate control and dehumidification operators.

Equipment Coverage and Replacement Costs

Equipment is the backbone of these businesses. Coverage should include protection against theft, damage during transport, and operational breakdowns. Given the inflationary pressures on repair and replacement costs, policies with replacement cost coverage rather than actual cash value are advisable. This ensures businesses can replace equipment without bearing unexpected out-of-pocket expenses. Furthermore, businesses should also consider adding coverage for specialized tools and machinery that may not be included in standard policies. For instance, advanced dehumidification units and climate control systems can represent a significant investment, and their loss could severely impact operational capacity.

Liability and Property Damage Protection

Liability coverage is critical. When working on client properties, accidental damage or bodily injury claims can arise quickly. General liability insurance protects against such claims, but businesses should also consider additional endorsements specific to climate control operations. For example, pollution liability may be relevant if refrigerants or chemicals are involved. Additionally, as the industry evolves, operators should stay informed about new regulations and standards that may affect liability coverage. This includes understanding the legal implications of using certain chemicals or technologies in their processes, which could lead to unforeseen liabilities.

Property damage claims often spike after severe weather events. Insurers are increasingly factoring climate risk into their assessments, which can affect coverage availability and premiums HVACInsure. Understanding these market dynamics helps businesses negotiate better terms and prepare for potential cost increases. Moreover, businesses should regularly review their property values and coverage limits to ensure they are adequately protected against the rising costs associated with repairs and replacements, especially in the wake of climate-related disasters.

Business Interruption and Contingent Coverage

Temporary climate control businesses depend on timely deployment. Interruptions caused by equipment failure, supply chain delays, or regulatory changes can halt operations and revenue. Business interruption insurance tailored to this niche can cover lost income during such periods. It is also essential for businesses to maintain detailed records of their operations and financials, as this documentation can be vital when filing claims. Insurers often require proof of income loss, and having organized records can expedite the claims process and ensure that businesses receive the compensation they need to recover.

Contingent business interruption coverage is also worth considering. It protects against losses caused by disruptions to suppliers or clients, which is especially relevant given the interconnected nature of disaster recovery efforts. As climate change continues to impact supply chains globally, this type of coverage can provide a safety net for businesses that rely on timely deliveries of equipment and materials. Additionally, establishing strong relationships with multiple suppliers can mitigate risks and enhance resilience against potential disruptions, allowing businesses to maintain operations even in challenging circumstances.

Climate Change Impact on Insurance for Climate Control Businesses

Climate change is reshaping the insurance landscape. The rising number of costly weather events has insurers re-evaluating risk models and pricing strategies. For temporary climate control and dehumidification businesses, this means premiums may rise and coverage terms may tighten.

In October 2024, Teague Insurance highlighted how climate change has significantly impacted commercial insurance in the U.S., driving up costs and prompting insurers to adopt stricter risk management approaches Teague Insurance. Businesses in this sector must stay informed and proactive.

Asset Value and Temperature Extremes

A study titled "Climate Risk and Corporate Value" found that extreme temperatures can reduce the asset value of enterprises. For companies relying on climate control equipment, this risk translates into both physical asset depreciation and operational challenges arXiv. Insurance policies need to reflect these realities to provide meaningful protection.

Moreover, as the frequency of heatwaves and cold snaps increases, the demand for climate control solutions is expected to surge. This heightened demand can lead to supply chain disruptions, as manufacturers struggle to keep up with the sudden influx of orders. Consequently, businesses may find themselves facing not only higher insurance costs but also increased operational expenses as they invest in more resilient equipment and systems to mitigate the risks posed by extreme weather.

Adapting to Regulatory and Market Shifts

Regulations affecting energy efficiency standards, such as the proposed rollback of dehumidifier standards by the U.S. Department of Energy, add uncertainty. Insurance providers may adjust coverage terms based on these regulatory changes, influencing premiums and coverage scope.

On the market side, insurers are incorporating climate risk into their financial assessments more rigorously. This trend affects underwriting decisions and could limit coverage options for businesses deemed high risk due to their operational exposure to climate extremes. Additionally, as insurers begin to prioritize sustainability, businesses that adopt greener practices may find themselves in a more favorable position when negotiating insurance terms. Insurers are increasingly looking to reward companies that demonstrate a commitment to reducing their carbon footprint and enhancing their resilience against climate impacts.

Choosing the Right Insurance Partner

Finding an insurer that understands the specific risks of temporary climate control and dehumidification businesses is crucial. Look for providers who offer customized policies, flexible endorsements, and expertise in climate-related risks. Building a relationship with an insurer who can advise on risk mitigation strategies adds value beyond just coverage. This partnership can also lead to tailored solutions that address unique challenges faced by your business, such as the need for specialized equipment or unique operational environments. A proactive insurer will not only provide coverage but also share insights on industry trends and emerging risks, helping you stay one step ahead.

Risk Management and Loss Prevention

Insurance is only part of the equation. Effective risk management reduces claims and can lower premiums. This includes regular equipment maintenance, employee training on safety protocols, and implementing procedures to handle extreme weather conditions safely. Additionally, consider conducting routine risk assessments to identify potential vulnerabilities in your operations. By engaging in proactive measures, such as investing in advanced monitoring technology or establishing emergency response plans, you can further mitigate risks. These strategies not only protect your assets but also enhance your reputation as a reliable service provider in the eyes of your clients.

Policy Review and Updates

Given the rapidly changing climate and regulatory environment, policies should be reviewed annually. Adjustments may be necessary to keep pace with inflation, new risks, and evolving business operations. Staying ahead of these changes ensures continuous protection without costly gaps. Moreover, it’s beneficial to maintain open lines of communication with your insurer throughout the year. This dialogue can facilitate timely updates on policy terms and conditions, as well as any new coverage options that may become available. Engaging in this ongoing conversation helps ensure that your insurance coverage remains aligned with your business goals and the realities of the marketplace.

Frequently Asked Questions

Q: What types of insurance are essential for temporary climate control businesses?

A: General liability, equipment coverage with replacement cost, and business interruption insurance are key. Additional endorsements may be needed depending on specific risks.

Q: How does climate change affect insurance premiums for these businesses?

A: Increased frequency of extreme weather events leads to higher claims, which insurers factor into premiums. Businesses in high-risk areas may see steeper increases.

Q: Can inflation impact my insurance coverage?

A: Yes. Inflation can increase repair and replacement costs beyond policy limits. Choosing replacement cost coverage helps mitigate this risk.

Q: Should I be concerned about regulatory changes affecting my equipment?

A: Yes. Changes in energy efficiency standards or other regulations can affect equipment costs and insurance terms. Stay informed and discuss impacts with your insurer.

Q: How often should I review my insurance policy?

A: At least once a year or after significant changes in your business operations or the regulatory environment.

Q: Is business interruption insurance necessary for temporary climate control companies?

A: Absolutely. It protects against lost income during equipment failures, supply delays, or other disruptions.

| Coverage Type | What It Covers | Why It Matters |

|---|---|---|

| Equipment Coverage | Theft, damage, breakdown, and replacement of climate control and dehumidification equipment | Protects costly assets essential for operations and reduces out-of-pocket repair costs |

| General Liability | Claims for bodily injury or property damage caused during operations | Safeguards against lawsuits and costly settlements from accidents on client sites |

| Business Interruption | Lost income due to equipment failure, supply chain delays, or regulatory disruptions | Ensures financial stability during unexpected operational halts |

| Pollution Liability | Claims related to environmental contamination from refrigerants or chemicals | Addresses specialized risks unique to climate control businesses |

Temporary climate control and dehumidification businesses operate at the intersection of weather volatility and regulatory complexity. Insurance coverage that reflects these realities is not just a safety net but a strategic asset. Staying informed, choosing the right policies, and partnering with knowledgeable insurers will help these businesses thrive despite the challenges posed by a changing climate.

Moreover, as climate patterns shift, the demand for temporary climate control solutions is likely to increase, presenting both opportunities and challenges for businesses in this sector. Companies may find themselves needing to adapt quickly to new technologies and methodologies that enhance efficiency and reduce environmental impact. This evolution can also influence insurance needs, as innovative equipment may require specialized coverage or endorsements to protect against emerging risks.

Additionally, understanding the nuances of local regulations and compliance requirements is crucial. For instance, businesses may need to navigate various state and federal guidelines regarding emissions or energy use. Engaging with industry associations and attending relevant workshops can provide valuable insights into best practices and help ensure that your insurance coverage aligns with both current operations and future growth strategies.

About The Author: James Jenkins

I’m James Jenkins, Founder and CEO of HVACInsure. I work with HVAC contractors and related trades to simplify insurance and make coverage easier to understand. Every day, I help business owners secure reliable protection, issue certificates quickly, and stay compliant so their teams can keep working safely and confidently.

Recognized by National HVAC Trade Associations

These trusted organizations set best practices and standards that carriers rely on when underwriting HVAC risks.

Membership signifies adherence to HVAC industry standards and contractor best practices.

Reviews

HVAC Contractor Reviews of

We're trusted by HVAC contractors throughout the US. Check out what our clients have to say about HVACInsure:

Coverage for Crews, Vehicles, and Tools

Insurance for HVAC Contractors

We provide business insurance designed for HVAC contractors. These policies protect your crew, vehicles, and tools while helping you meet project requirements. Every policy is explained clearly and delivered quickly so you can work without delays.

Resources

Insurance Tips for HVAC Contractors

Our blog is built for contractors who want fast answers. Each article covers common questions and risks in under five minutes of reading.

Frequently Asked Question

Common HVAC Contractor Insurance Questions

These FAQs address common contractor questions. As HVACInsure grows, we will update this section with real client experiences and answers.

Why should an HVAC contractor use HVACInsure instead of a general agency?

Specialists understand jobsite requirements, certificate wording, and common endorsements for HVAC work. You get cleaner paperwork, faster approvals, and coverage that fits how your crews operate.

This reduces delays at the gate, avoids gaps, and helps you pass compliance checks the first time.

How fast can I get a Certificate of Insurance (COI)?

Most standard COIs are issued the same business day after binding or updates. If you need additional insured, primary/non-contributory, or waiver language, we prepare it correctly the first time.

Our goal is simple: get your crew on site without paperwork delays.

What coverages do HVAC contractors usually need?

Core policies include General Liability, Commercial Auto, Workers’ Comp, Property/Tools, Inland Marine, and Umbrella. Many projects require higher limits and specific endorsements.

We align your coverage with contract terms and explain each choice in plain language.

Will my tools and scheduled equipment be covered in vans or on jobsites?

Yes. Inland Marine (tools and equipment) can cover items in transit, stored in vehicles, or staged on site.

High-value items can be scheduled, and limits can match your daily field use to keep work moving.

Can I lower my premium without weakening protection?

Often, yes. Clean driver lists, accurate payrolls, safety programs, and bundling policies can help.

We review your profile, request carrier credits, and adjust limits and deductibles to control cost while meeting project requirements.

What should I do after a loss?

Contact us right away so we can file with the correct carrier and set expectations. We guide documentation, next steps, and follow-ups until closure.

Fast reporting and clear records help resolve claims sooner and keep your team focused on work.

Still have questions?

Can’t find the answer you’re looking for? Please chat to our friendly team!

Contact Us